The Supply Mirage

- Winter 2026 Series Begins

- Circular Economy Origins

- An Unanticipated Future Arrived

- Diagnosis

- Prognosis

- Prescription

- Provocations

Winter 2026 Series Begins

Today we start our third series: On the Bubble.

Introduction to Circudyne was about architecture: why circularity requires a coherent transformation framework rather than a loose collection of principles or best practices.

A Circudyne Odyssey stepped back further, adventuring under a constellation of thinkers and ideas that have informed the development of that framework.

On the Bubble takes a different perspective. This series is about taking stock. Its purpose is to establish the ground truth of the circular economy as it exists today — judged both on its own original terms and against the needs, constraints, and expectations that have emerged since.

The question is no longer whether circularity is compelling as an idea, but whether it is equipped, in its current form, to deliver on what it promised for the world as it now is.

Circular Economy Origins

By any reasonable measure, the circular economy arrived as an exemplary act of marketing. It did not attempt to invent a new worldview from scratch, but instead embraced and extended existing bodies of work — Performance Economy, Cradle to Cradle, Biomimicry — bringing them together under a single, legible banner.

The concept itself was unusually compelling. Circles are friendly, tidy, and intuitively complete; “closing the loop” compresses complex material, industrial, and economic processes into a phrase that feels both rigorous and reassuring.

Its global debut was equally well timed. When circularity was introduced to business leaders at Davos, it spoke directly to a moment when sustainability needed a language that de-emphasized sacrifice.

It framed environmental responsibility in economic terms — the word economy was right there in the name — and for a time, that framing carried real momentum.

An Unanticipated Future Arrived

Yet more than a decade on, circularity has not advanced in the way that early momentum suggested it might. In practice, the circular share of the global economy continues to decline, down 2.2% in the last 10 years to 6.9% in 2025.

At the level of the firm, we are still waiting for widespread examples of brands that have transformed themselves such that they can profitably deliver circular solutions at scale, rather than pilot them at the margins.

And in the broader culture, the mood has shifted. Regular people do not know what circularity is or why it is necessary. Sustainability no longer carries the optimism it once did; consumer attention is fragmenting, regulatory pressure is amped, and fatigue is setting in.

Diagnosis

These are not failures of intent. They are signals that the conditions under which circularity first took hold have changed; and that the idea must now be evaluated not by its elegance or appeal, but by its ability to perform under pressure.

When the circular economy entered the mainstream in the early 2010s, it was responding to a specific set of conditions. Material costs were volatile and widely expected to rise. Waste was increasingly visible as an economic inefficiency, not just an environmental externality. Global supply chains appeared stable enough to support just-in-time optimization, but brittle enough to make resource efficiency a competitive concern.

Circularity promised to resolve these tensions by redesigning material flows so that value could be preserved, recovered, and compounded rather than lost.

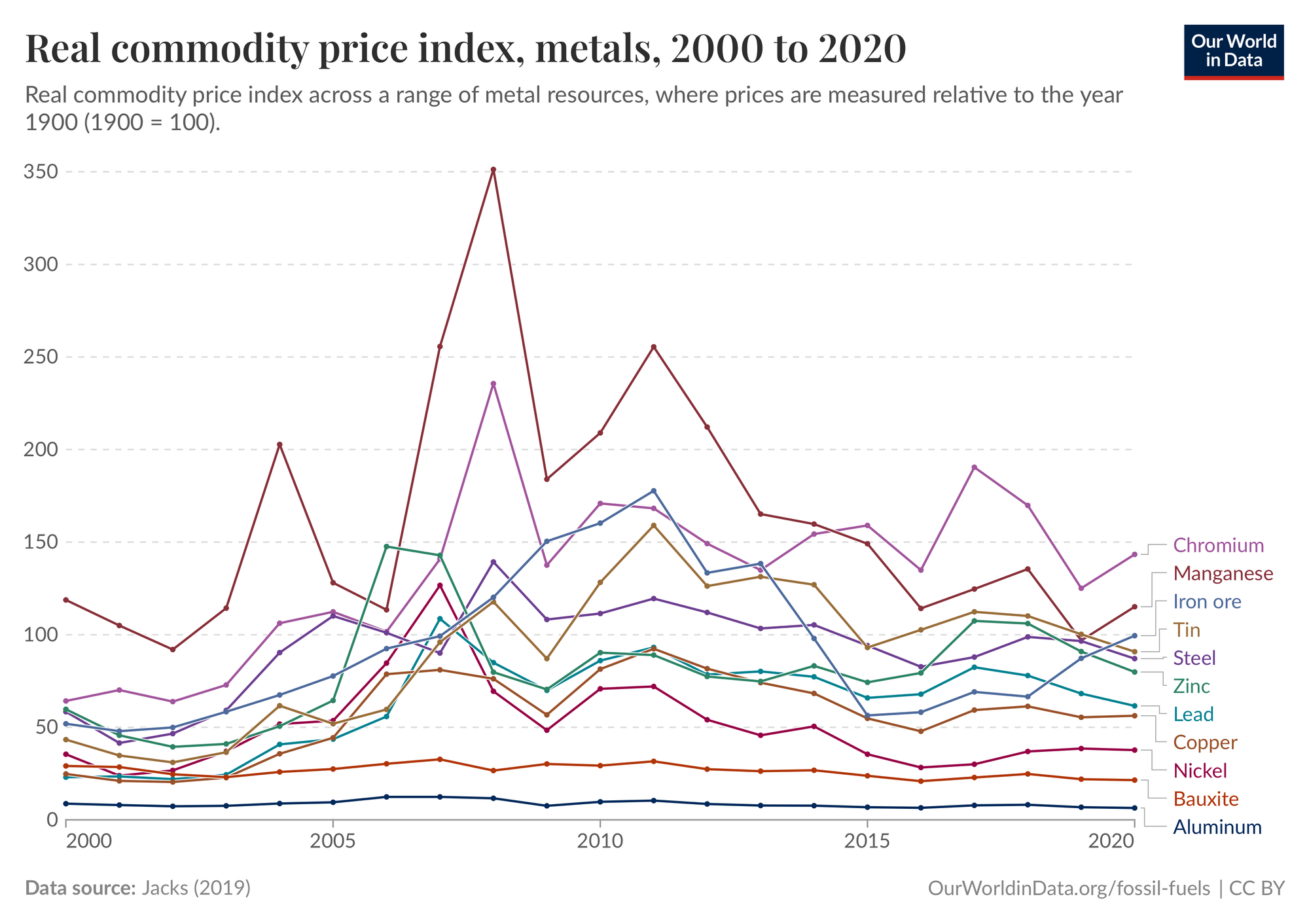

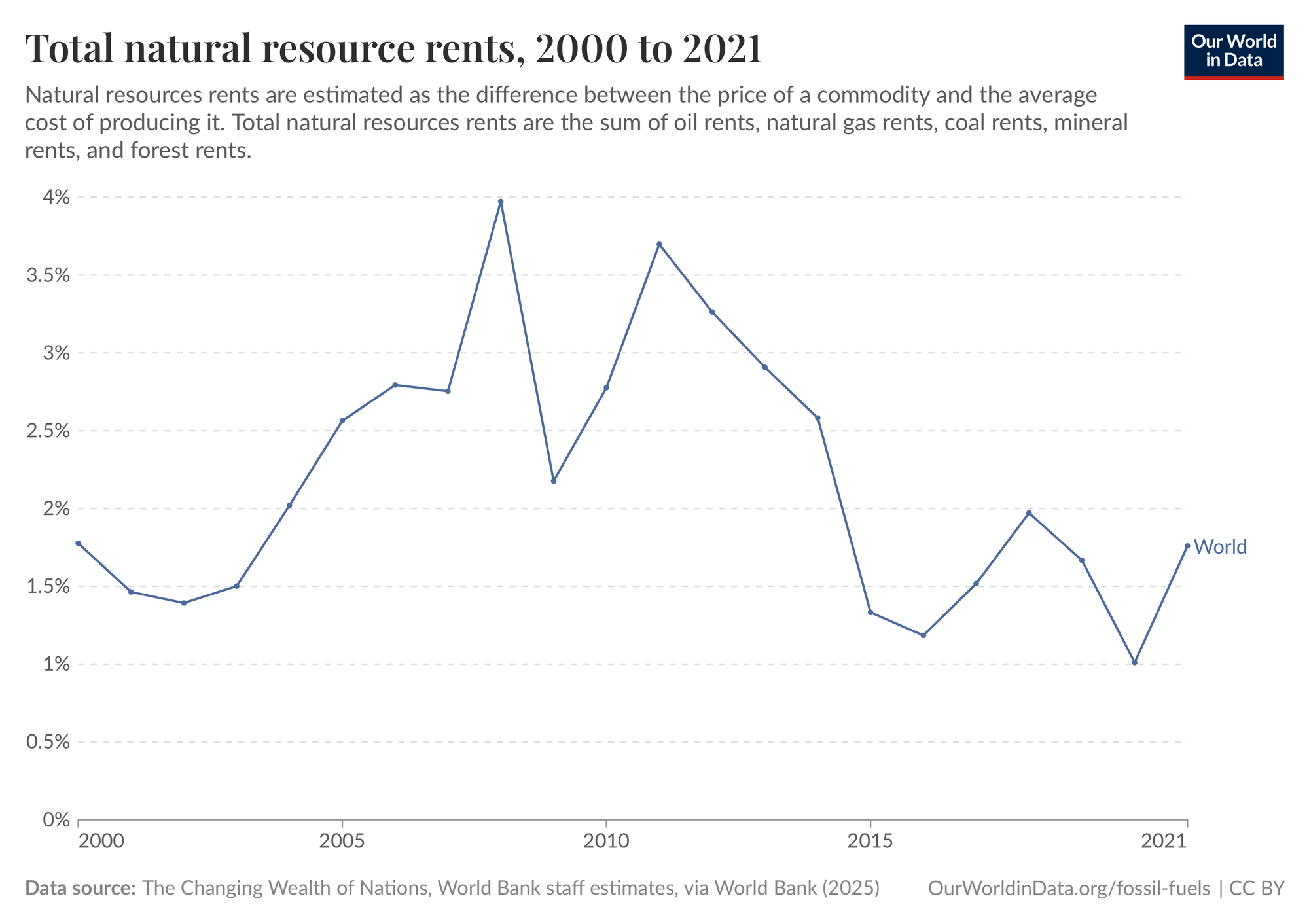

Many of the assertions that animated circularity’s early momentum were reasonable at the time. Commodity prices were expected to trend upward. Scarcity — particularly of energy- and resource-intensive inputs — was framed as a long-term structural constraint.

Efficiency, reuse, and substitution were positioned as rational hedges against a more expensive, resource-constrained future. Circularity offered a way for firms to respond without abandoning growth or competitiveness.

But the landscape has not evolved in a straight line. Material prices have fluctuated unevenly rather than steadily risen.

Globalization extended some efficiencies even as it masked new vulnerabilities. Meanwhile, risks that were underweighted in circularity’s early framing have moved decisively to the foreground. The international trade regime has frayed. Geopolitical fragmentation has turned certain materials like rare earths, critical minerals, and energy inputs into strategic assets rather than commodities. Resilience, not just efficiency, has become a board-level concern.

Commodity prices and resource rents tell a story of stasis. In the years leading up to circularity’s mainstream debut, both price levels and volatility appeared to be trending upward across a wide range of materials. That context made the economic case for circularity feel urgent and intuitive. Since then, however, those trends have not persisted in aggregate.

Prices have fluctuated, rents have risen and fallen, but neither has exhibited the sustained upward trajectory that would force systemic redesign.

This matters because it clarifies circularity’s role. Material scarcity and price volatility are risks circularity can mitigate, but have proven insufficient, on their own, to drive transformation at scale.

It is worth acknowledging why the first wave of circular economy thinking focused so heavily on the supply side. Following price signals is a familiar and seductive strategy. Rising input costs create clear incentives; efficiency gains can be quantified; redesigns can be justified internally without asking markets or consumers to change their behavior.

Compared to the harder work of inventing new solutions, new business models, and new jobs to be done for the consumer, responding to supply-side pressure is comparatively straightforward. That this was the dominant expectation in the early 2010s reflects prudence, not naïveté.

Prognosis

But the failure of sustained price pressure to materialize changes the calculus. In a comparatively stable supply environment, there are no efficiency gains from circularity sufficient to offset an amortized and optimized linear status quo.

If circularity is to advance under these conditions, it cannot rely on cost pressure alone. It must turn to the demand side by creating offerings that people actively choose, with business models capable of serving that demand at scale.

There is also a deeper distinction at work here, one that helps explain why this shift has proven so difficult. Price signals are something managers follow. Demand, by contrast, is something leaders generate through invention, judgment, and an evolving understanding of what people actually need.

Prescription

That distinction matters. Circularity’s next phase will depend less on optimization and more on imaginative leadership. What that entails, and why it has been so elusive, will be the focus of the next Circudyne Letter.

Below, for DYNAMO members: three provocations that move beyond diagnosis toward possibility, designed to help leaders think more clearly about what circularity must now deliver. Your support helps sustain the mission behind The Circudyne Letter.

Subscribe to continue reading